As being a reaction to our request for comments [seventy eight] on regardless of whether we must always involve equivalent deferments for Direct Loan borrowers with fantastic balances on FFEL loans created before 1993 toward IDR forgiveness, a couple of commenters responded with the perspective that we should include time invested on these deferments towards forgiveness.

Executive Get 13563 also requires an company “to employ the very best offered methods to quantify predicted present and upcoming Gains and fees as correctly as feasible.

The Department thinks that thinking of the share of revenue that goes toward university student loan payments is really an insufficient way to take into consideration cross-place comparisons. Different nations supply differing levels of assist for meeting basic fees connected to foods and housing. They also have distinct Charge bases. Housing in one region could be kind of very affordable than another. Relative incomes and national wealth may possibly change at the same time. Therefore, comparing the relative deserves of different pupil loan repayment constructions is not really as simple as merely comparing the share of revenue devoted to payments.

As described, the Division has the authority to promulgate this closing rule. The variations made in this rule will eventually decrease confusion and make it a lot easier for borrowers to navigate repayment, opt for irrespective of whether to make use of an IDR program, and prevent delinquency and default.

Inside the IDR NPRM and With this closing rule we seemed to knowledge and information regarding the problem for pupil loan borrowers in the United States and we think that is the proper resource for building by far the most appropriate and ideal-knowledgeable determinations about how to framework the alterations to REPAYE During this rule.

(two) Create a serious inconsistency or in any other case interfere having an action taken or prepared by another company;

We feel that our restrictions at § 685.210(a) present an adequate framework describing once the Division notifies borrowers about the repayment ideas available to them if they to begin with pick a prepare ahead of repayment. In addition, § 685.209(l)(eleven) currently offers that we'll track a borrower's progress towards eligibility for IDR forgiveness. In the GAO report [93] cited via the commenter, the GAO suggested that we should deliver additional information about IDR forgiveness, like what counts for a qualifying payment towards forgiveness, in communications to borrowers enrolled in IDR options. The recommendation further more pointed out that we could provide this information to borrowers or direct our loan servicers to provide it. In reaction towards the GAO, we concurred with the recommendation and identified actions we might get to put into action that advice. As Element of the announcement on the one particular-time payment count adjustment We now have also talked about how we will likely be generating improvements to borrowers' accounts so they are going to Possess a clearer image of progress towards forgiveness.

The Department hasn't and will not suggest borrowers that they can hope to repay a fraction of whatever they owe. The goal of these rules, which employ a statutory directive to deliver for repayment based on earnings, is to make it less difficult for borrowers to repay their loans whilst making certain that borrowers who do not have the fiscal sources to repay tend not to go through the lasting and harmful repercussions of delinquency and default.

Eventually, it is vital to remember that many of the financial savings which are happening for these graduate borrowers are resulting from The truth that they also have undergraduate loans. That means had they in no way borrowed for graduate faculty they might continue to be viewing some of These savings.

Many commenters argued that we should waive collection service fees completely for the people producing payments below IDR or produce a statute of limits on collection costs.

A person commenter mentioned that there's no persuasive rationale to forgive desire since the remaining balance is previously forgiven at the conclusion of the loan phrase. A different commenter argued which the Office was incorrect on its situation that fascination accumulation will address issues of borrowers remaining discouraged to repay their loans.

The Section thinks the REPAYE system as laid out in these closing rules focuses appropriately on supporting quite possibly the most at-danger borrowers, simplifying alternatives within IDR, and earning repayment simpler to navigate.

We now have clarified that only borrowers who will be repaying a loan around the PAYE or ICR strategy as of July 1, 2024, may possibly proceed to make use of Those people ideas Which if such a borrower switches from All those strategies they'd not be capable of return to them. We maintain the exception for borrowers that has a Direct Consolidation Loan that repaid a Mum or dad Furthermore loan.

The procedure of IRS data sharing for FFEL Method loans isn't a regulatory difficulty 88 cash and is not resolved in these procedures.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Michael Bower Then & Now!

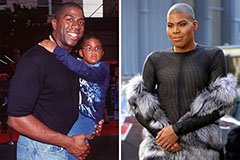

Michael Bower Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!